Reposting outside of finserv group, our recent roundtable with

Box Insurance Overview and Box and Guidewire Integration. Recording clip here

Demo of Insurance Agent. Recording clip here

Full recording here

Content Management: The Backbone of Insurance

Recording clip here

-

"80% of underwriting decisions rely on documents submitted by brokers and agents."

-

"60 to 70% of claims cycle time is driven by document intake and review."

According to IDC, 90% of organizational data is unstructured, presenting an opportunity.

Box AI: Transforming Content Management

Centralized Content Management

With its centralized structure, Box empowers legal departments, repair vendors, claims adjusters, underwriters, and others to work on a single version of a document—eliminating redundancy and errors while boosting efficiency.

-

"You have that one version that can be leveraged across teams, collaborate with repair vendors and things,"

@protella commented.

Demo Insurance Workflow Automation with Box and Guidwire

Recording clip here

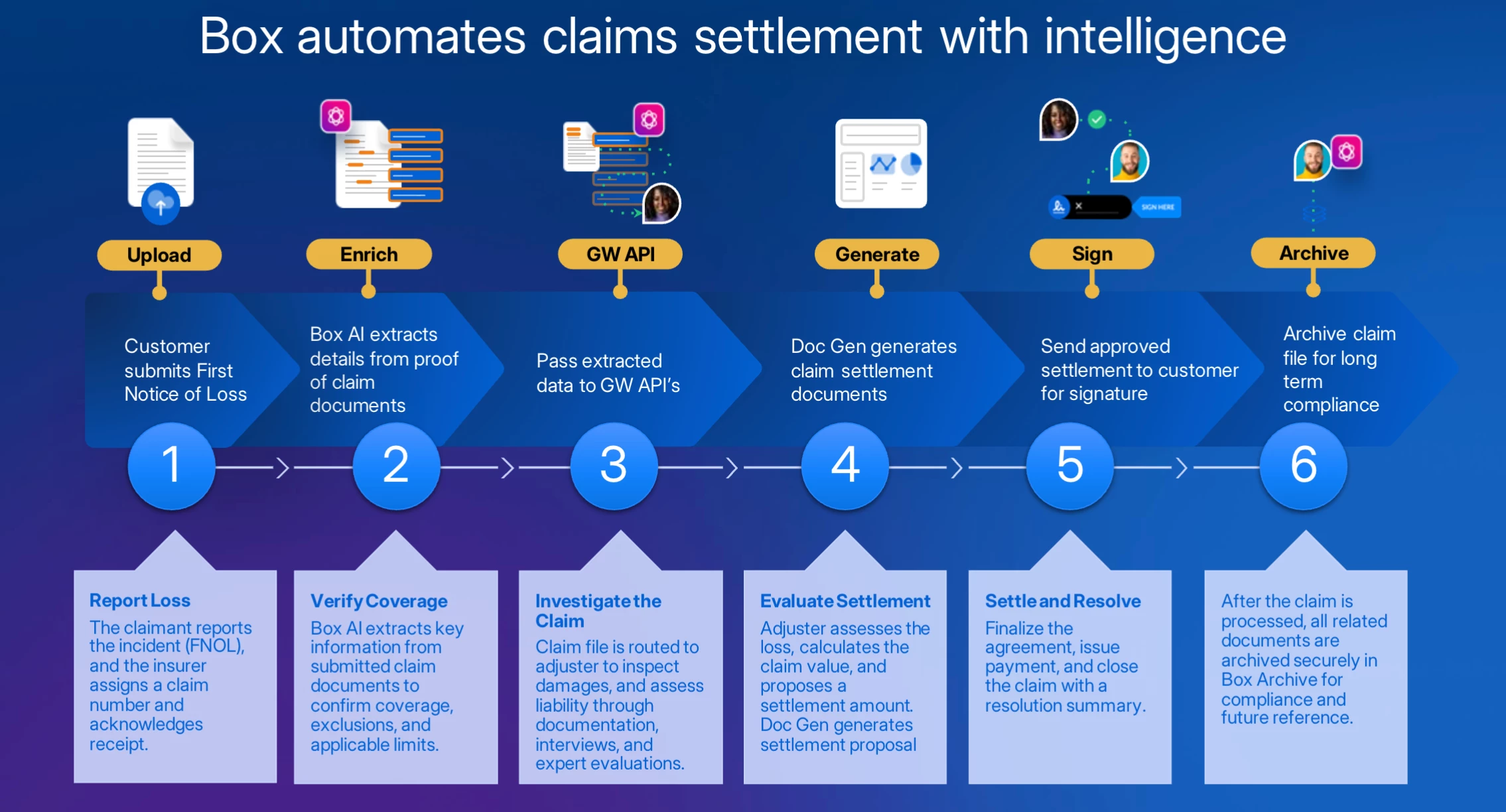

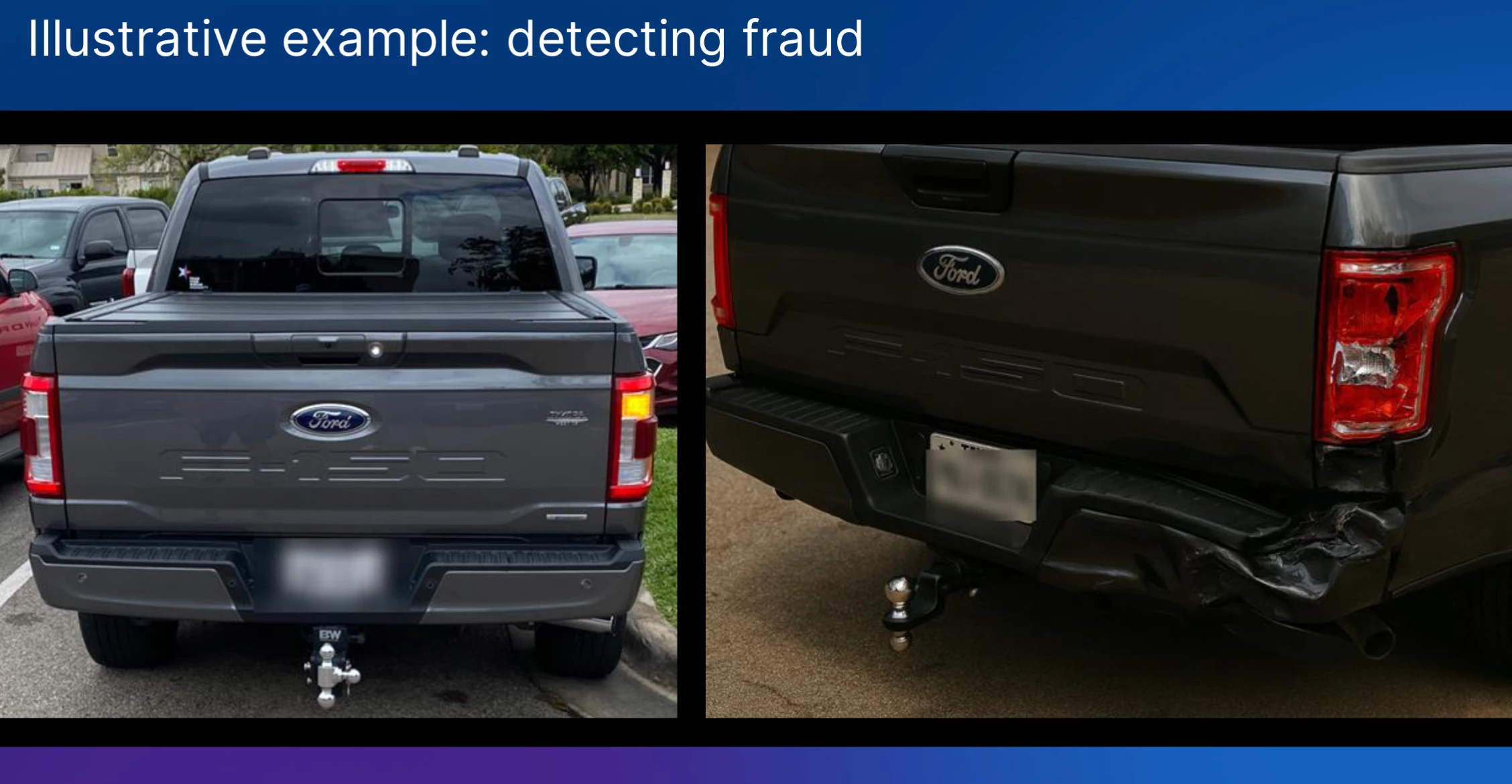

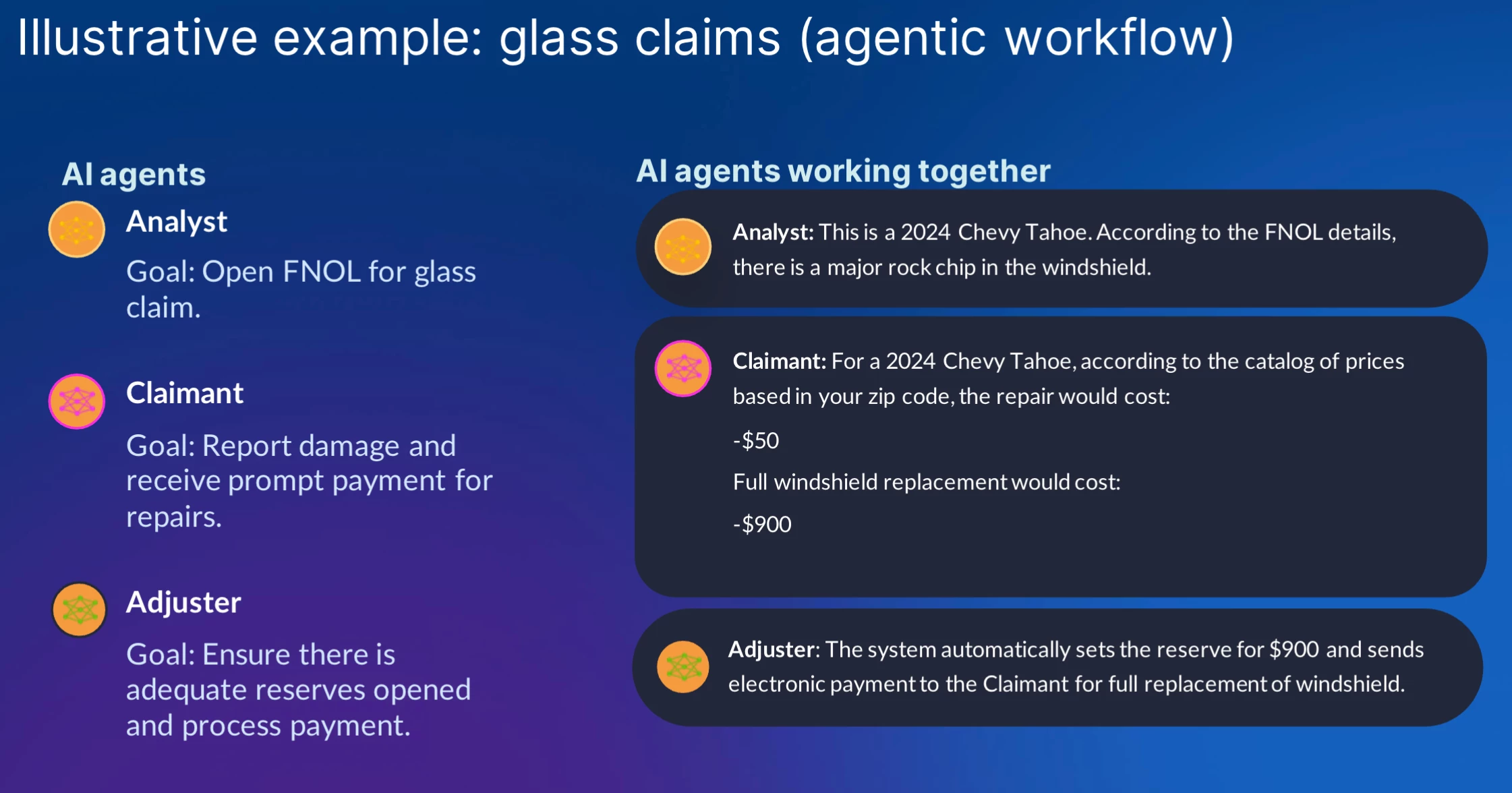

Amanda Chivil demo’ed Box’s capability in automating manual data-entry tasks, accelerating claim resolution, and improving accuracy.

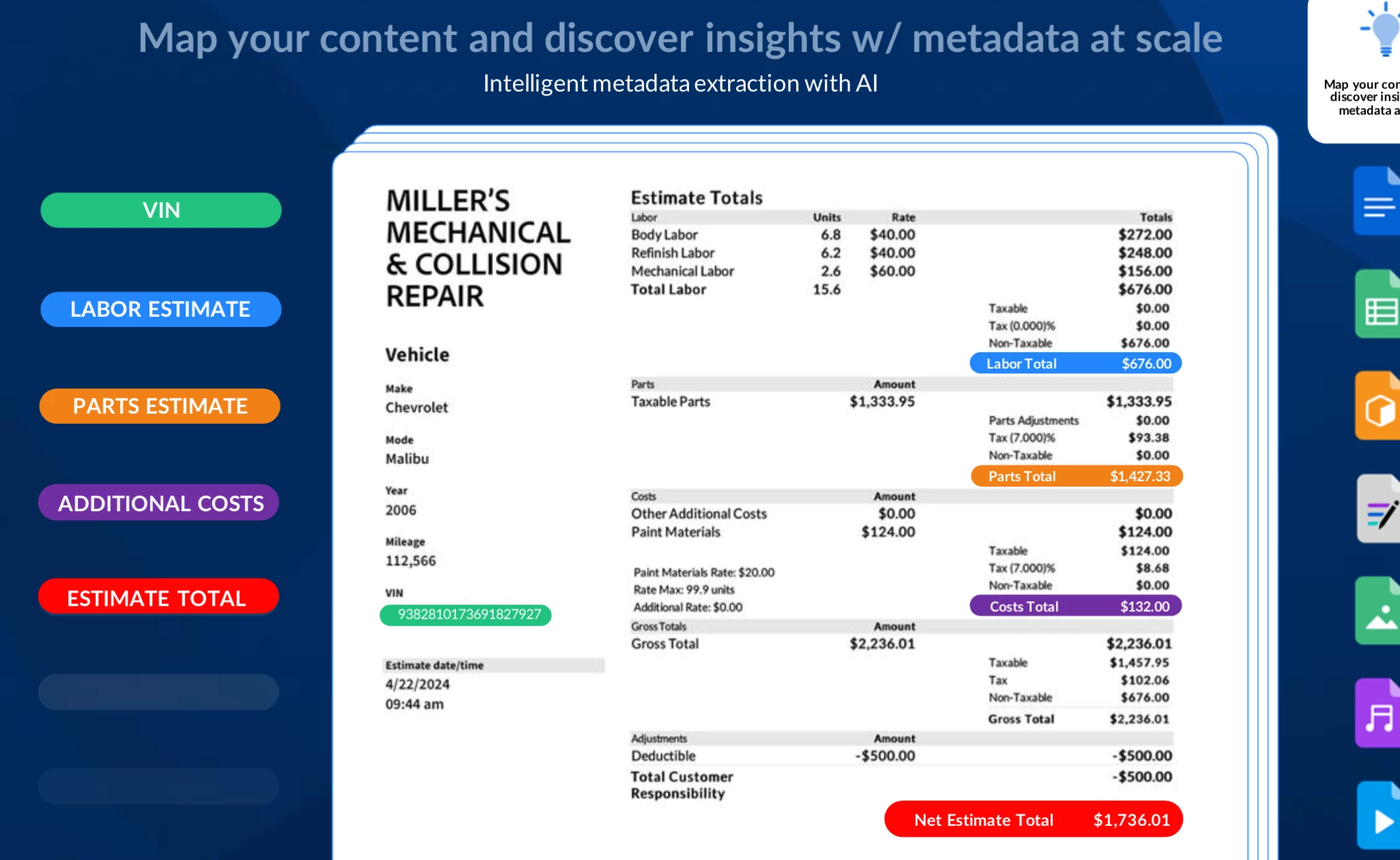

For example, Amanda demonstrated a claim processing workflow where Box AI automatically extracted details like health insurance numbers, diagnosis codes, provider information, and other essential data from a document. She noted how generative AI allows insurers to transform unstructured data into insights that are searchable, actionable, and secure.

Metadata extraction ensures that insurers can structure and categorize data from complex documents, fostering compliance and enabling faster decision-making. “This brings structure to unstructured data and makes this information searchable,” Amanda highlighted.

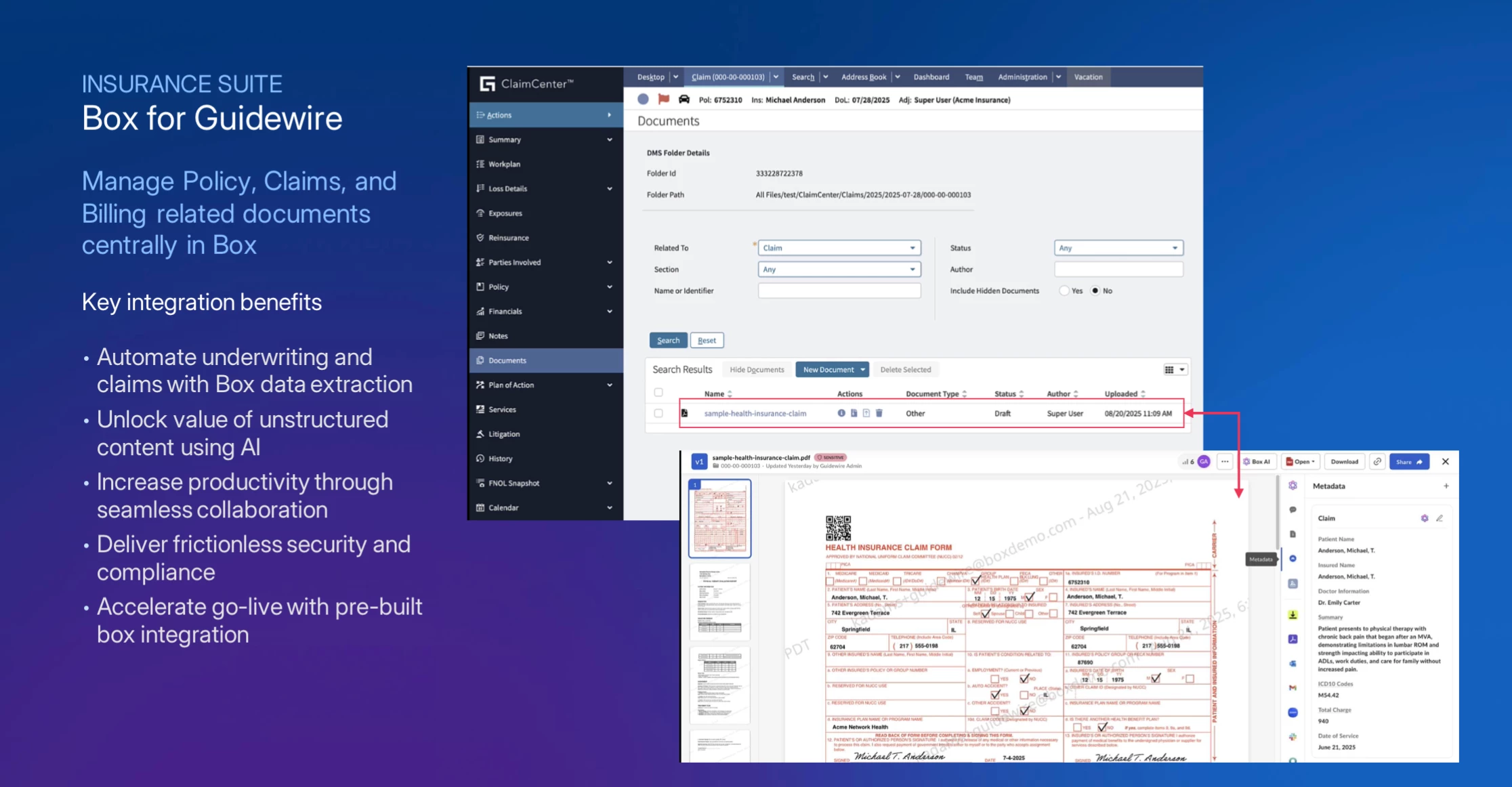

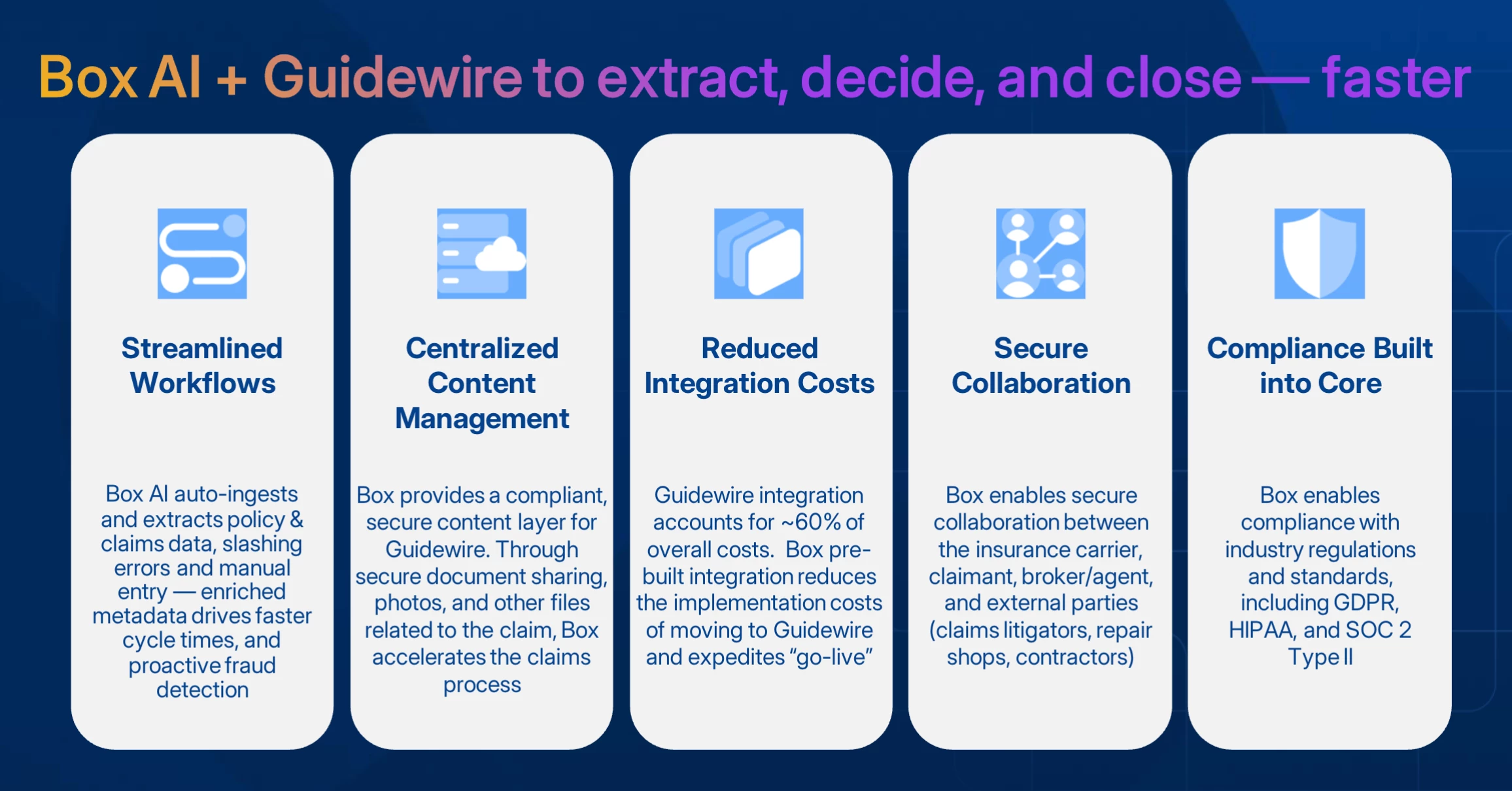

Integration with Guidewire for Insurance Workflows

-

Streamlined Policy Submissions and Claims: Box AI ingests and extracts policy and claims data, reducing manual processes and accelerating decisions.

-

Cost Reduction: Integration costs with Guidewire can be minimized through connections to Box’s core systems, saving insurers resources.

The integration also ensures compliance. Box Shield Pro automatically detects sensitive content, such as Social Security numbers and medical diagnoses, applying classifications and security features like watermarks, restricted sharing, and blocked downloads. “Any document processed in the claims workflow is protected with the right security controls and guardrails,” Amanda added.

This partnership has already earned recognition:

-

At a recent earnings call, Guidewire CEO Mike Rosenbaum celebrated Box’s capabilities: "Insurers can now automatically categorize and analyze claim documents, extracting critical information...to accelerate claims processing and enhance accuracy."

-

Box was recently named “Global Technology Partner of the Year” by Guidewire, signifying its leadership in bringing innovation to insurers worldwide.

Custom AI Models and Flexibility

A common concern for insurers is the diversity of document types—some claims may involve handwritten notes, complex medical diagnoses, or text-dense policies.

Perry noted, “We're model agnostic...you can pick and choose your model. If one model becomes more sophisticated over time for certain document types, you can use it.” Further customization can be achieved with Box Labs, a collaboration process where insurers fine-tune AI models to fit their specific needs.

Amanda echoed this sentiment, stating: “For different document types, we apply different metadata templates...we work with you closely during the implementation phase to ensure you have the right taxonomy and information governance structure.”

Looking ahead, Amanda mentioned upcoming developments that will allow customers to integrate their own large language models (LLMs) into the Box environment, further expanding the potential for custom AI applications.

Real-World Success Stories

To showcase the power of Box and Guidewire,

-

Bamboo Insurance quickly implemented the content platform to streamline operations.

-

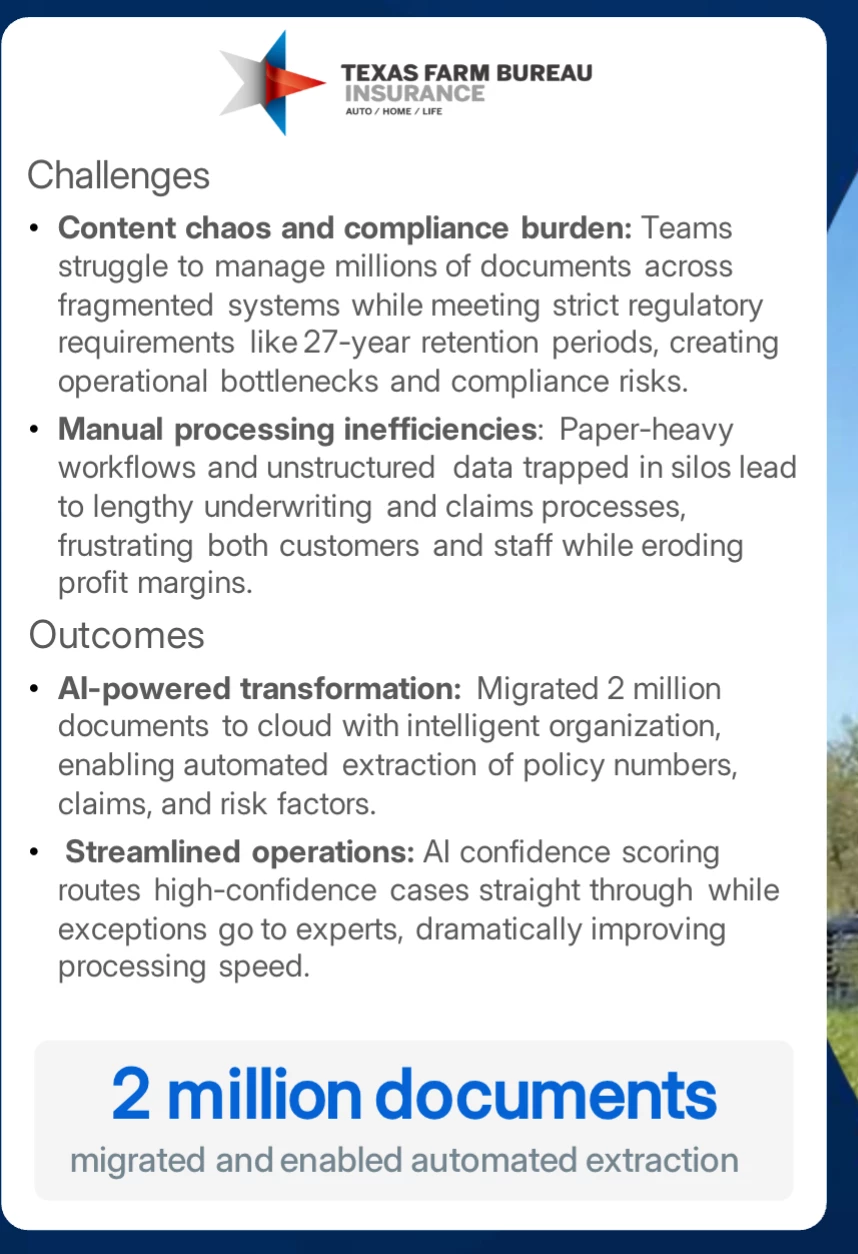

Texas Farm Bureau Insurance overcame “content chaos” by adopting a content-first strategy using Box as its unified platform. This move paved the way for company-wide AI adoption, enabling efficient document management and advanced analytics.